Make your 2X MATCHED gift today!

This week only: Every $1 will be matched with $2 to enable women worldwide.

This week only: Every $1 will be matched with $2 to enable women worldwide.

Our Goal: Program SAFE will transform the financial system so that 100 million women and vulnerable people are safe from financial abuse and gain financial autonomy.

Financial abuse invisibly but acutely disempowers billions of women and other vulnerable people worldwide. Not only does it rob them of their savings and ruin their credit, financial abuse also puts women and their children at risk of physical harm as it deepens their dependence on abusive family members.

Financial abuse also damages the economic stability of the financial sector. Financial institutions do not truly ‘know their customer’ - a stringent requirement of the global system - when abusers manipulate a woman’s account ownership. Furthermore, ensuring women's full financial inclusion would unlock US$700 billion in revenue within the financial system each year, while reducing financial abuse will help stem the 1- 4% of countries’ Gross Domestic Product lost annually to gender-based violence (GBV).

Program SAFE will build the evidence base and broad public awareness of the issue, support stakeholders to put in place critical safeguards, revise international standards on mitigating risks to customers, and leverage prior campaign experience to catalyze change at a systemic level.

Are you interested in supporting or collaborating with Grameen on Program SAFE? Contact Bobbi Gray, Associate Vice President, bgray@grameenfoundation.org

Grameen Foundation gathered together a panel of experts including representatives from FreeFrom and Center for Survivor Agency and Justice, and Consumer Bankers Association to discuss how Financial Institutions in the US can protect, prevent, and enable recovery from financial abuse.

Hosted by Grameen Foundation Associate Vice President, Programs, Bobbi Gray and featuring speakers:

Zubaida Bai, Grameen Foundation President and CEO

Erika Sussman, Center for Survivor Agency and Justice

Kelvin Chen, Consumer Bankers Association

Hye Sun Kim, FreeFrom

Grameen’s Research on Economic and Financial Abuse

Financial Abuse Research Paper by Grameen Foundation & Cerise+SPTF

Research Paper: Grameen Foundation and Cerise +SPTF developed a survey to measure financial abuse, conducting phone interviews with around 200 women clients from two anonymous financial institutions in Benin. Results showed low self-reported rates of financial abuse but higher prevalence when discussing community challenges. Directors from both institutions acknowledged awareness of financial abuse among customers and noted actions taken, such as customer training and confidentiality policies, to address the issue. The resulting paper informs Cerise+SPTF's project aimed at enhancing outcomes management for better inclusive finance products and services.

Playbook: The Role of Financial Institutions in Responding to Domestic Financial Abuse

Playbook: The Role of Financial Institutions in Responding to Domestic Financial AbuseThis playbook outlines the context and opportunities for financial institutions (FIs) in the United States (US) to address financial abuse but its intent is to describe emerging best practices and inspire innovation among FIs located anywhere in the world, especially among those serving the most vulnerable.

Financial Abuse Research Compendium

Compendium: Please note, this compendium is a work-in-progress and is periodically updated as new research and experiences inform our thinking.

Report: Research conducted in Honduras which includes use of an economic coercion scale developed by Kathryn Yount (Emory University) and other researchers.

Press Releases:

Unveiling a Groundbreaking Initiative to End Financial Abuse: Program SAFE

Grameen Blog Posts:

Announcing The Launch Of Program SAFE

How Harmful Gender Norms Encourage Financial Abuse

Taking Action Against Financial Abuse

Determining The Right Starting Point For Addressing Financial Abuse

Designing Financial Services With Safety In Mind

Unpacking Our Financial Ancestry: Managing Money As A Couple

Are We Safeguarding From Fraud Or Financial Abuse, Or Both?

Grameen Foundation Board Chair, Elisabeth Rhyne, Blog:

Recent Speaking Engagements and Presentations:

Global Summit on Economic Abuse

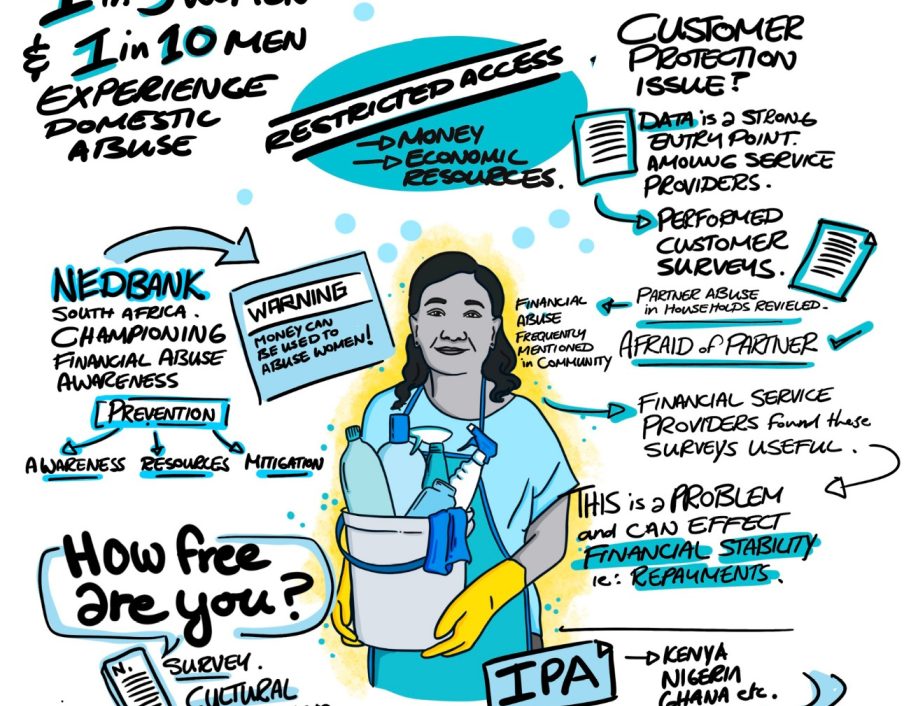

NO MORE and the International Coalition Against Economic Abuse, November 18, 2025. Panelists included Bobbi Gray, Grameen Foundation; Ramo Phalatse, NedBank South Africa; Meseret Haileyesus, Canadian Center for Women’s Empowerment (CCFWE); Dr. Celiwe Ndaba, Medical Doctor, South Africa; Lensa Biyena, Ethiopian Mediation and Arbitration Center (EMAC).

Recording coming soon!

Financial Empowerment

The Healing Continuum - Domestic Violence Conference, Volunteers of America - Greater New York, October 8, 2025. Panelists included Bobbi Gray, Grameen Foundation and Mandy Kelso, TD Bank.

Financial Freedom Understanding Domestic Financial Abuse & Our Consumer Protection Responsibilities

Center for Financial Inclusion, October 8, 2025. Panelists included Bobbi Gray, Grameen Foundation; Amelia Greenberg, CERISE + Social Performance Task Force; William Blackmon, Innovations for Poverty Action; Ramo Phalatse, NedBank South Africa

Fighting Economic Abuse

BBC News World Service, Business Daily, October 1, 2025. Panelists included Felicity Hannah, BBC News; Bobbi Gray, Grameen Foundation, Nicola Sharps-Jeffs, All Things Economic Abuse.

Breaking the Silence: How Financial Institutions Can Prevent Financial Abuse

Impact for Breakfast, September 17, 2025. Panelists included Bobbi Gray, Grameen Foundation; Sazini Mojapelo, International Finance Corporation; Buli Mbha, NedBank South Africa

Making the Invisible Visible: Safeguarding Women from Financial Abuse at Home

European Microfinance Week, November 14, 2024. Panelists included Bobbi Gray, Grameen Foundation; Aude de Montesquiou, CGAP/Finequity; Nicola Sharps-Jeffs, Economic Abuse Expert and Independent Consultant; Claudia Belli, BNP Paribas

Understanding Financial Abuse: Why the Financial Sector Should Care?

Financial Inclusion Week 2024 hosted by the Center for Financial Inclusion, October 18, 2024. Panelists included Bobbi Gray, Grameen Foundation; Swati Mehta Dhawan, Finequity/CGAP; Amelia Greenberg, Cerise+SPTF; Ryan Burke, World Bank Group - International Finance Corporation. You can watch the recording for free after registering here.