Make your 2X MATCHED gift today!

This week only: Every $1 will be matched with $2 to enable women worldwide.

This week only: Every $1 will be matched with $2 to enable women worldwide.

Founded in 1997, Grameen Foundation was established to end poverty by turning Professor Muhammad Yunus’ vision of microfinance into a globally recognized concept. In that time, we have partnered with local organizations to lead programs in 78 countries.

With significant success, we harnessed technology to amplify our impact and broadened our mission to include ending hunger through our merger with Freedom from Hunger in 2016. Since 2016, we have impacted over 29 million people.

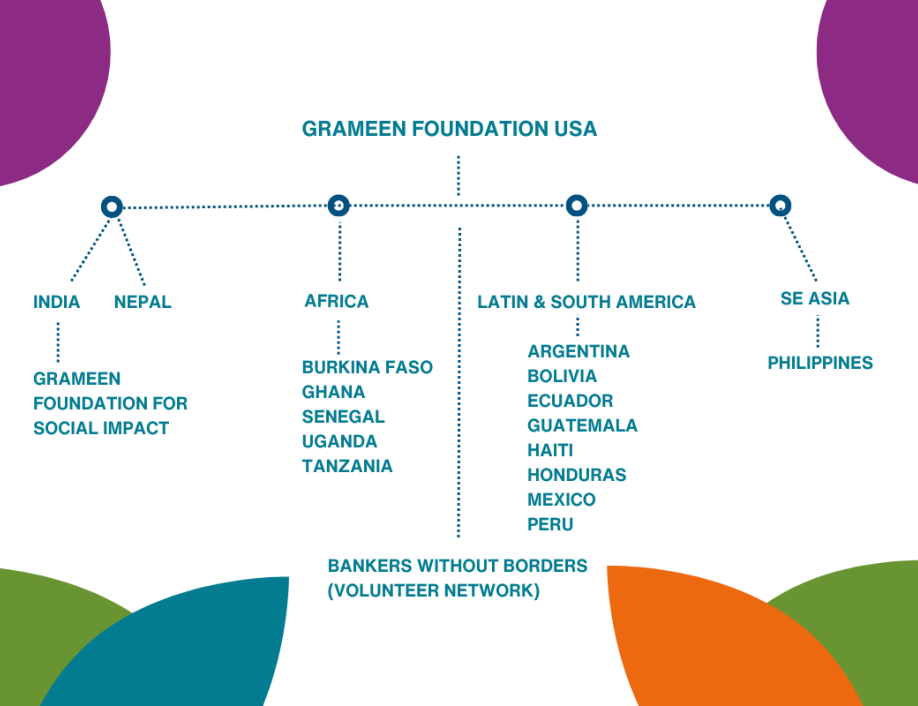

Today, Grameen Foundation (GFUSA) operates in the U.S and globally with two subsidiaries and two independent affiliates under our scope.

A social enterprise is a for-profit venture created to measurably impact the lives of vulnerable people.

Grameen Foundation is pleased to have created and spun off several of its own social enterprise initiatives (Taroworks, MOTECH and PPI) as well as partner with more impact-driven enterprises.

Capital market investments are playing an increasingly crucial role in helping developing countries to grow their economies. We invest in companies, funds and joint ventures to create capital for social enterprises whose products and services benefit the poor. Moving from a “funding” model to a sustainable “financing” model enables a win for investors and a permanent escape from poverty. Our current investments include:

Grameen Capital India is a financial advisory firm that helps socially focused organizations in India obtain capital to grow and reach more clients. Founded in 2008 by Grameen Foundation, IFMR Trust and Citicorp Financial India Ltd, Grameen Capital India helps microfinance institutions get the funding and support they need to serve India’s poor. Today, it works with microfinance institutions, affordable healthcare providers, low-cost education firms and others, from early-stage enterprises to established industry leaders. Its current shareholders are L&T Finance (which bought a 26 percent stake in July 2015), Grameen Foundation, Citicorp Finance, Amit and Arihant Patni. In 2015, it launched an investment arm, Grameen Impact India.

Grameen Impact Investment India is a non-bank financial institution backed by Grameen Capital India, bringing an in-depth understanding of the impact investing ecosystem and liquidity support to build scale.

Grameen Impact shareholders include leading domestic and global impact investors. Grameen Impact will use the financing to make loans to high impact social enterprises in India in sectors including financial services, affordable healthcare, affordable education, renewable energy and sustainable agriculture.

In 2008, Grameen Foundation launched BwB, in collaboration with strategic partners with Fortune 500 companies and individuals, BwB sources some of the world’s brightest minds and strategically connects them as volunteers with high-potential social enterprises and nonprofits. The work of BwB is an essential partner in the fight against global poverty, with a focus on improving scale, sustainability, and impact.

Growing from just 100 volunteers in 2008 to more than 23,000 today, BwB has business professionals, academics, and students from 174 countries standing ready to contribute their time, skills and expertise to strengthen poverty-focused organizations. Since inception, BwB has consulted for 264 social enterprises, donating over 27.3 million of in-kind services.

Learn More About BwB