Make your 2X MATCHED gift today!

This week only: Every $1 will be matched with $2 to enable women worldwide.

This week only: Every $1 will be matched with $2 to enable women worldwide.

Posted on 06/06/2024

Part Three In Our Program SAFE Blog Series

In blogs 1 and 2 in this series on financial abuse, we announced Program SAFE and described the possible prevalence for financial abuse and some of Grameen’s early experiences studying financial abuse in Honduras. In this blog, we will outline what we see as practical steps financial service providers can do to address financial abuse.

In late 2023, I wrote an initial blog on economic violence. We were coming close to wrapping up a project where we had a chance to take a deeper dive into the concept of economic abuse. Fast forward to today, we’re talking specifically about financial abuse. Why? This is the form of gender-based violence (GBV)--and a sub-category of economic violence or abuse--that is the most relevant for ALL financial service providers (FSPs) and where we believe FSPs have the most obvious responsibility.

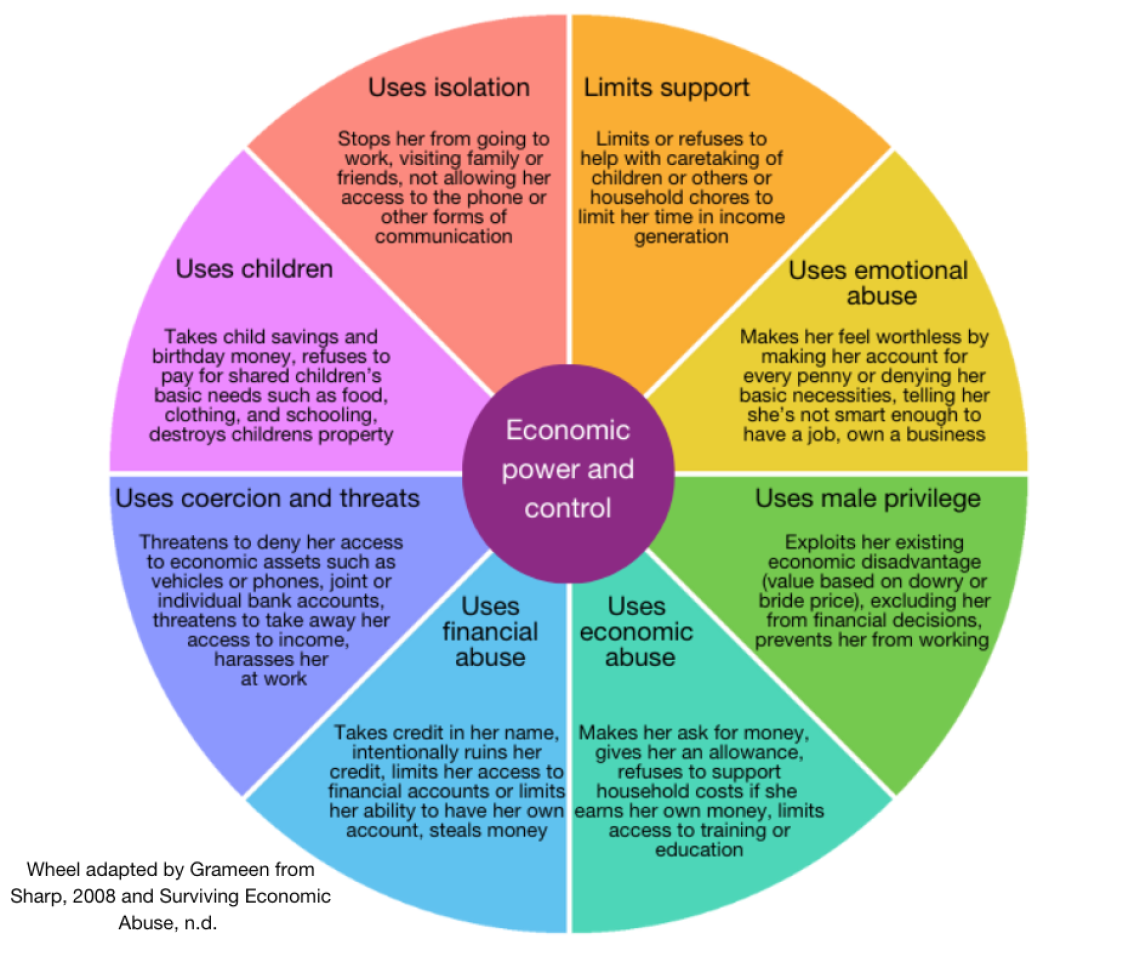

The wheel below builds off work of the UK-based nonprofit Surviving Economic Abuse (SEA). We have split out SEA’s original ‘uses economic abuse’ category into ‘uses economic abuse’ and ‘uses financial abuse’ to help focus on the aspects of financial abuse that FSPs can most influence through their day-to-day work. We also made some adaptations to descriptions of other wheel categories to reflect the low-income country settings in which most of our FSP partners work.

If we focus on the financial abuse risks that FSP clients can face, at a minimum we know we should mitigate the risks that an abuser can: find out details about her or her accounts that she has not given the FSP permission to give him, take out credit in her name (without her full consent), intentionally ruin her credit (by coercing her to take credit that she may or may not have control over), limit her access to financial accounts or ability to have her own account or steal her money. This list is not exhaustive.

There is still so much to learn about how financial abuse is experienced in different contexts around the globe. However, building on Grameen’s experience working at the intersection of financial services and GBV and the existing literature, we have found a crisis management framework helpful to categorize steps FSPs can take. This list of steps is also not exhaustive but suggestive of actions an FSP can take. We hope through Program SAFE we will be able to add depth and breadth to this list.

Conduct research to understand people’s experiences with financial abuse to guide FSP decisions.

Engage FSP management and frontline staff in sensitization workshops on gender and harmful gender norms that may limit the FSP’s ability to sensitively respond to GBV survivors. Once FSP staff can better identify how FSP-client and client household power dynamics influence a client’s engagement with the FSP and its products, they can more clearly identify pain points in the customer experience pathway.

Stress-test current financial products, services, and the customer experience pathway for their potential risk of increasing or exposing women to financial abuse and make improvements. For example, is communication with the client, i.e. engaging with the client at home or at her business or through text messages, putting her at risk if she is trying to hide the presence of her account? Is a client’s partner/spouse required to sign applications of any type?

Passive Communication: Post flyers in public spaces that outline signs of financial abuse and provide contact numbers for special support at the FSP and with external GBV/domestic violence support groups.

Active Communication: Train all clients on signs of financial abuse, ways they can protect their financial lives, where they can go for extra support.

Utilize intra-household dialogues to engage couples about collaborative money management.

Develop a financial abuse code or policy and related practices.

Develop a special customer service team to provide extra support to clients to protect their financial accounts and lives.

Flag any accounts of clients who have revealed their abuse status or who are worried about potential financial abuse so that they do not have to repeat their story when they seek support from the FSP.

Train frontline staff on how to detect financial abuse, what to say/not to say to someone who has revealed financial abuse and how to safely provide information on national or local GBV support services.

Develop a linkage with local GBV service providers when abuse has been revealed, to connect survivors with support. Contact these services and even the police, if the client agrees.

Design new onramps into the financial services sector for survivors by engaging with GBV service providers/women’s support organization to create “graduation”-like programs (financial services + business/financial education + mentoring, etc.) that enable survivors to rejoin mainstream financial services..

Catherine Fitzpatrick wrote in Designed to Disrupt: Reimagining banking products to improve financial safety, “Financial products are designed as if relationships are healthy, couples make joint decisions, people don’t exploit others.” This is now our challenge: how do we design (and improve) financial products and services that acknowledge that not all relationships are healthy and that power dynamics within a couple (or household) can result in the abuse of another? This design assumption should become the norm and not the exception if we’re to successfully mitigate the risks of financial abuse.

In our next blog, we’ll share how we’ve used our Exploring Power Dynamics engagement initiative as a methodology for addressing harmful norms at the FSP level.