Make your 2X MATCHED gift today!

This week only: Every $1 will be matched with $2 to enable women worldwide.

This week only: Every $1 will be matched with $2 to enable women worldwide.

Posted on 06/20/2024

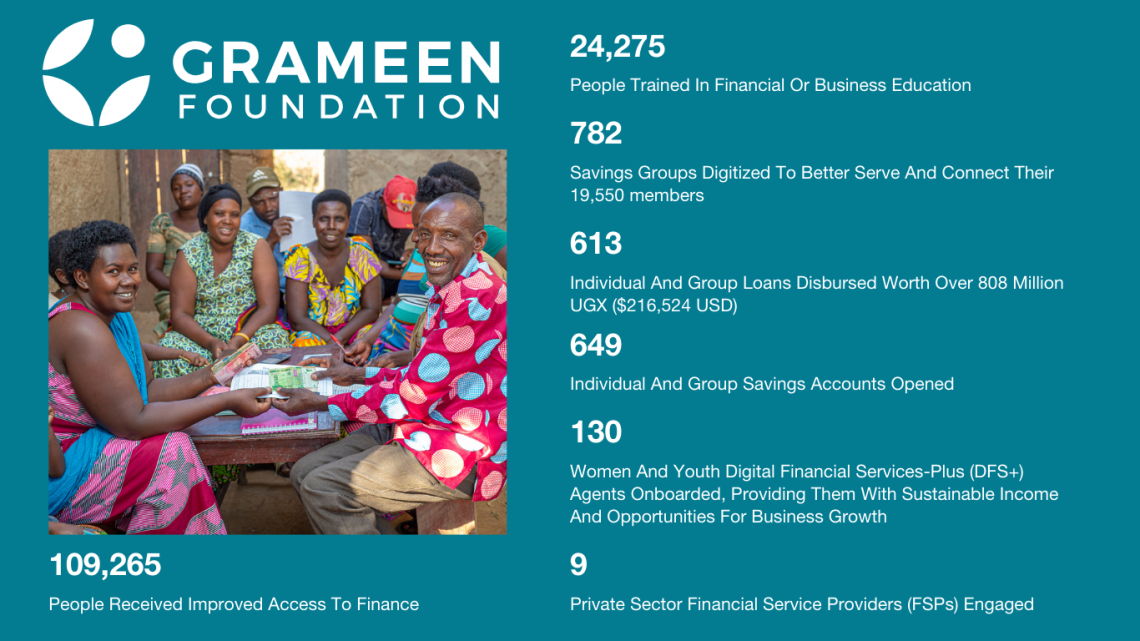

Today, as we celebrate World Refugee Day, I am reflecting on the achievements and best practices of Grameen’s work with refugees, and the enormous challenges that still await us in a world that is increasingly fractured by conflict and climate change. Over five years ago, Grameen Foundation launched our Refugee Finance program with just 2,500 people in northwestern Uganda. Now, thanks to the hard work of our staff and local partners, we have reached over 109,000 refugees and host communities with expanded access to finance for business growth.

In the coming weeks, we want to share a little insight on the Refugee Finance program: 1) the needs we are trying to address as the refugee and forced migration crisis grows; 2) how we got where we are –our vision, best practices and approach; and 3) what we have learned along the way.

What is Grameen’s Refugee Finance Program?

Through innovative private sector partnerships and the power of digital financial services, Grameen’s Refugee Finance program works to build a more enabling ecosystem for refugees in Uganda, especially women and young people, to access finance for business growth. Our vision is to engage the private sector, including local Ugandan microfinance institutions, banks, telecoms and fintechs, to provide the financial services that are missing from refugee settlements and could make the difference to turn around peoples’ lives. By promoting sustainable, market-driven solutions, we ensure that local private sector businesses will continue to offer equitable financial services both during our donor-funded project period, and well beyond—and a path for successful refugee entrepreneurship is enabled.

Why do refugees need financial services?

Uganda hosts one of the largest refugee populations in the world (including people fleeing from conflicts in South Sudan, Democratic Republic of Congo, Somalia, Burundi, and Rwanda) and works closely with the United Nations, donors and aid organizations to ensure that these refugees have the food and supplies they need to live safely and securely. 81% of these refugees are women and children (UNHCR, Refugee Statistics Sep. 2023, Active Population by Settlement). And the government also has one of the most progressive refugee policies in the world, allowing refugees the right to work, move freely within the country, access social services, and even giving each newly arrived refugee family a plot of land and materials to build their temporary home. But as conflicts flare, and climate change affects communities around the world, the amount of aid available to support refugees in Uganda is reducing. Last year, the amount of food assistance given to each refugee family reduced by 70%.

In this climate, the Government of Uganda, aid and development agencies like Grameen are looking for new solutions that enable refugees to transition from aid dependency to long-term self-reliance. In short, we want to help refugees build their own businesses and grow their own food so they can support themselves without depending on aid. But most refugees came to Uganda with little more than the clothes on their back, and they need finance (small loans) to grow their businesses beyond a micro-level.

If you want to learn more, check out our Refugee Finance Program Case Study.