Make your 2X MATCHED gift today!

This week only: Every $1 will be matched with $2 to enable women worldwide.

This week only: Every $1 will be matched with $2 to enable women worldwide.

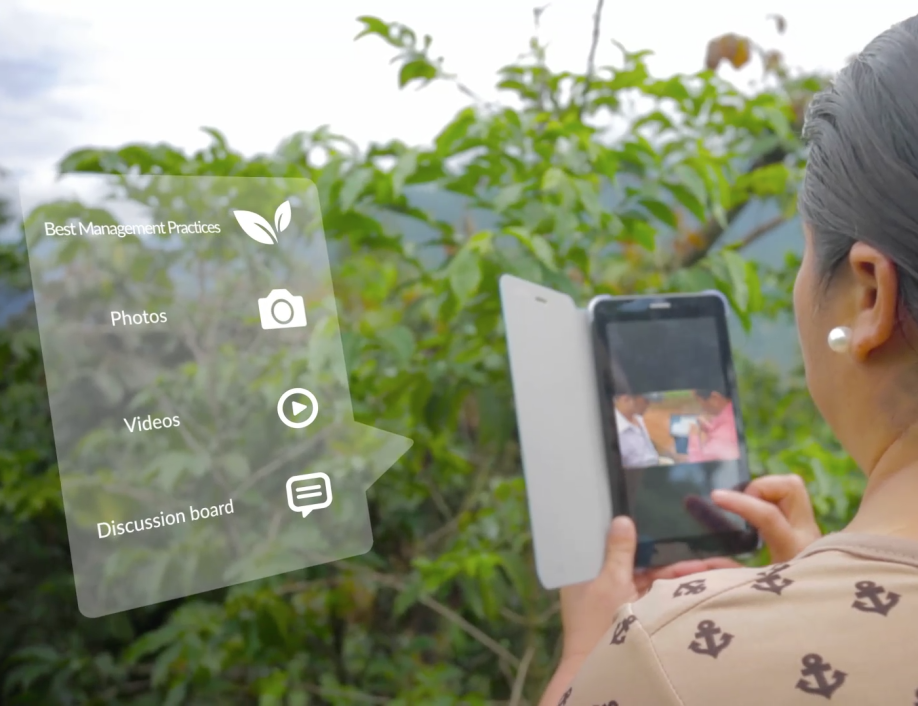

Grameen collaborated with Mars, Inc and Rainforest Alliance to develop the FDP for cacao. Through the FarmGrow mobile application, field officers of cocoa traders collect farm-level data that is analyzed using “smart logic” to allow for personalized FDPs that guide farming households to plan ahead and better manage cost and financing of their farming operations. Most importantly, the “business” plan provides a snapshot of the potential income (or loss) over the long-term that can be generated from following recommended practices.

Under FarmerLink, Grameen developed a strategic alliance that included the Philippine Coconut Authority and private-sector coconut buyers, including Franklin Baker and Nutiva, as well as Planet Labs, Stichting Progreso, financial service providers, food companies and agronomists. Grameen developed a suite of mobile extension tools that worked in an integrated fashion to help farmers strengthen their businesses, build resilience and mitigate losses due to climate change and extreme weather while serving the profit-making, policy, and other interests of the partners.

Grameen partnered with the world’s first cashless MFI, Musoni Kenya, to enhance its technological capacity and increase its reach to smallholder farmers. Using human-centered design research and business model innovation, Grameen and Musoni designed a loan specifically for smallholder farmers, who were previously unable to borrow. One of the loan product’s most popular features is its customization to unique seasonal financial needs of the agricultural households and farmers’ cash flow. Musoni embedded a digital field application to its lending processes which enable time-sensitive agricultural loans to be disbursed within 72 hours to clients’ mobile wallets.

In Tanzania, Grameen piloted a digital layaway scheme in alliance with Positive International Limited, a regional input supplier, and with Vodacom’s M-Pesa mobile money service. The solution provided farmers with a digital Crop Investment Plan to advise farmers on correct input applications and other good agricultural practices. By making small deposits toward the cost of the inputs over time, farmers could afford to buy the relevant inputs at the right time without the need for expensive credit.

LedgerLink is a groundbreaking, fully functional, Android application that allows rural savings group members to digitally record their day-to-day meeting information, as well as savings, loan and social fund transactions via a group smartphone, enabling the automatic calculation of loan repayment information. Data on group performance, savings and loans is stored on the cloud and readily available to NGO program staff, financial institutions, and any other stakeholders of the group’s choosing.

In collaboration with GSMA and MTN Uganda, Grameen has developed a digital financial literacy curriculum to serve the needs of refugee populations.

With Millicom through its Conectadas initiative, Grameen is developing digital financial literacy content for an app that will be used by women in nine Latin American countries.

Grameen Mittra is a network of female agents who, as self-employed women working within their communities in India, offer a digital platform that allows people to access DFS, financial and livelihood development products/services, and customer education on the doorsteps of women living in remote communities. Mittras grow their business through diversified offerings from multiple financial service providers and private sector partners, and by reaching groups of underserved people such as via self-help groups. Mittras also transform their own lives by learning new skills, generating new income and increasing their financial independence.

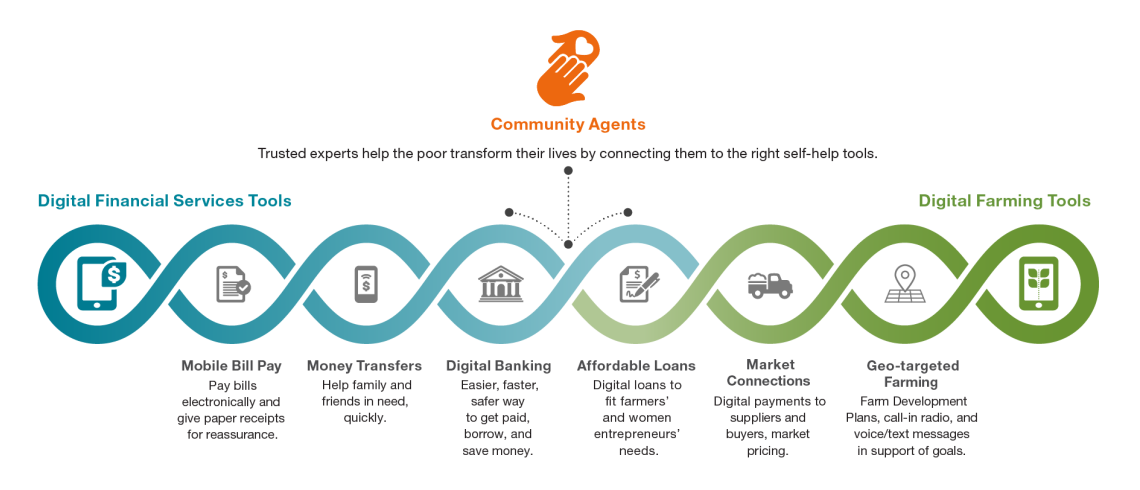

Community Agent Network (CAN) is a telco-agnostic, last-mile agent network that delivers financial services to underserved and unserved rural Filipino customers through the use of mobile-enabled payments platforms.

TaroWorks™ is a social enterprise whose mobile-based data tool enables organizations to use fresh data and timely feedback as the standard for setting and reaching their goals. With TaroWorks, organizations serving poor and remote areas can efficiently collect, analyze and act on field data.

A first-of-its-kind e-learning app in India for microfinance institutions, G-LEAP enables anytime, anywhere training of front-line microfinance staff and agents. It works quickly and cost-effectively, helping agents engage, educate and motivate microfinance clients. G-LEAP allows front-line workers to learn on the job while continuing to serve their clients. Watch this video to learn firsthand about G-LEAP.

Grameen is working to elevate the model of the Sustainable Development Goal (SDG) Impact Bond pioneered by Grameen Capital India and Grameen Impact India. SDG Impact Bonds have proven effective in India in enabling small and medium-sized enterprises to overcome collateral and guarantee requirements commonly set by financial service providers, and thus advance their social and business goals.

Grameen is currently establishing a new $30 million early-stage venture fund, called GrameenStart, to continue pursuing innovation in financial inclusion, while also promoting a broader spectrum of social enterprises serving poor women in the informal economy and other underserved groups, including rural segments. GrameenStart focuses on promising, underfinanced early-stage ventures that are poised to positively impact the lives of poor, rural women and other underserved groups in low and lower-middle-income African and Asian countries. GrameenStart will provide customized packages comprised of seed funding, equity, quasi-equity and/or debt investments, and a technical assistance sidecar.

Through its Bankers without Borders® (BwB) business executive volunteer initiative, Grameen brings talent and skills from Fortune 500 companies and academia to bolster the scale, sustainability, and impact of social and pro-poor enterprises worldwide. Since 2008, BwB has recruited more than 23,000 volunteer consultants from 174 countries around the world, to deliver professional support to more than 260 social enterprise clients in 48 countries, totaling more than $27.3 million worth of pro bono services. BwB volunteers bring backgrounds in banking and finance, technology, marketing, management consulting, M&E, research, and human resources to provide technical assistance support for short, medium, and longer-term, virtual, or field-based assignments. BwB strives to bring on the most relevant and qualified consultants while minimizing the costs of travel and partners’ time investment.

Grameen Foundation developed the Poverty Probability Index® (PPI®). It is a powerful low-cost tool used by hundreds of organizations in 40 countries to measure household poverty, and to track and improve performance. Grameen Foundation managed PPI for its first ten years. In 2016, we partnered with Innovations for Poverty Action (IPA) to develop the PPI Alliance, a collective governance and funding structure. Grameen Foundation is a founding and core partner of the Alliance, which is housed with IPA.

Cerise+SPTF is a joint venture of two leading global organizations dedicated to social and environmental performance management—a way of doing business that puts people and the planet at the center of every decision. The Social Performance Task Force (SPTF) and Cerise operates under a Memorandum of Understanding to support financial service providers, social businesses, impact investors, networks, professional associations, regulators, and donors—a wide cross-section of stakeholders from all over the world—with the tools they need to achieve their social and environmental strategies.

Grameen has designed and facilitated a series of four economic strengthening trainings that support development organizations focused on programming for orphans and vulnerable children. The trainings enable organizations to select and follow best practice related to savings group, graduation, and cash transfer programming.

Under the WAGE initiative, Grameen has jointly developed and deployed a barrier assessment tool to identify constraints and opportunities for women’s economic empowerment.

Grameen trains and supports local partners to facilitate gender dialogues that engage men and women in conversation about traditional gender roles and how they can act as barriers to effective household decision-making for optimal health, and food and nutritional security. The dialogues develop incentives for change in gender relations and encourage more gender-equitable household food distribution and decision-making regarding the use of household resources.

In order to integrate the issues of child labor alleviation and acceptable conditions of work into WEE initiatives, and in partnership with the American Bar Association Rule of Law Initiative, Grameen is developing and deploying a new toolkit to better equip policymakers and service providers to educate women entrepreneurs and ensure women-led enterprises can improve livelihoods responsibly, and comply with laws protecting children and promoting acceptable conditions of work. After testing in two strategic locations, El Salvador and the Philippines, the RICHES tools will become available for broader distribution and global application.